'Repo rate hike on expected lines'

December 07, 2022 15:05

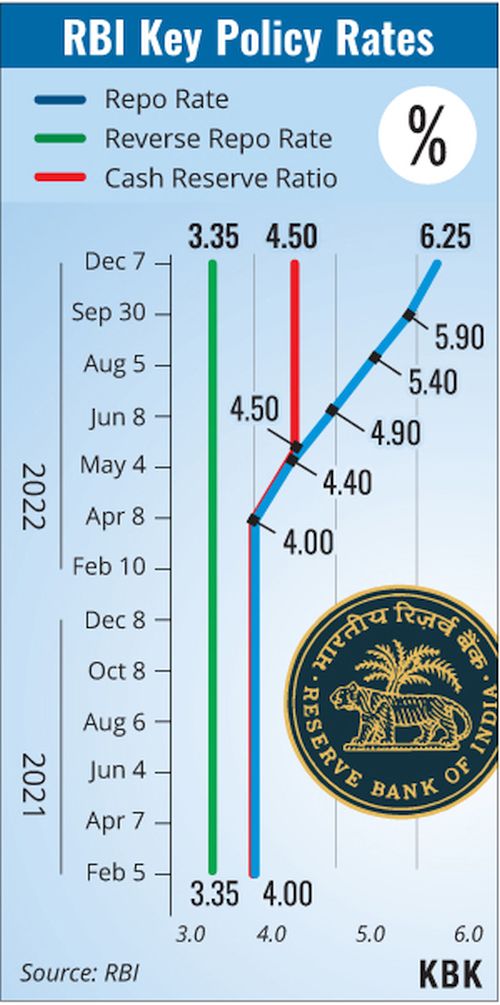

The monetary policy committee of the RBI, comprising three members from the bank and three external members, raised the key lending rate or the repo rate to 6.25 per cent by a 5:1 majority decision. Four of the six members voted in favour of the withdrawal of accommodation, RBI Governor Shaktikanta Das said.

Reactions are in:

Abheek Barua, Chief Economist and Executive Vice President, HDFC Bank: The RBI policy announcement today was in line with expectations in terms of raising the policy rate by 35bps and keeping the policy stance unchanged. However, the policy tone was distinctly more hawkish than expected.

When a central bank combines its sanguine view on growth with continued concerns on inflation -- particularly the persistence in core inflation -- it suggests that it is prepared to continue its fight against inflation and has the space and willingness to raise rates further.

There were other signs in the governor's statement that suggested that tightness in financial conditions could intensify going forward. While the RBI continued to reiterate that it would continue to manage liquidity conditions through finetuning operations, it cautioned markets to wean themselves off the surplus liquidity overhang and not take it for granted.

Today's policy announcement does provide a soft support for the rupee ahead of the Fed meeting next week and can be viewed perhaps as an attempt by the RBI to continue aligning itself with the still hawkish G7 central banks.

Nitin Bavisi, Group CFO at Ajmera Realty & Infra India: The RBI's decision to hike the repo rate by 35 bps is on the much-expected lines with the primary goal of keeping inflation in check.

Although this will lead to a marginal rise in lending rates, it may not be of much deterrence for the real estate industry backed by the positive sentiments of homebuyers and strong demand influenced due to the price rise of Indian real estate in the days to come.

The current stance on the repo rate will have lower impact on the mortgage rate, as the pace of hike has been moderated and hence perceived positively by the home buyer. 'Inflation has been moderating as RBI has been keenly focused on the evolving changes and taking real-time corrective action in the best interest of economic growth as it continues to float above 4 per cent in the next 12 months.

Ravi Singhal, CEO, GCL: We expect crude to fall significantly from its recent high. If the government passes this on to consumers, we believe the RBI will pause in its next policy. We also believe that the market will remain neutral in the coming days and that it will set new highs in December.

Amit Gupta, MD, SAG Infotech: The market expects the governor to announce the end of the rate hiking cycle, but current policy shows no evidence of it. Nevertheless, the economy is not responding well to the programme. It might not be a financial event with significant intraday volatility.

According to the MPC, more targeted monetary policy intervention was required to anchor inflation expectations, break core inflation persistence, and manage second round impacts.

Suren Goyal, Partner, RPS Group: RBI's recent stance to increase the repo rate to cut down on the rising inflation is a welcome step. The present rate of inflation has crossed 6.7% and it is essential for the RBI to take a strong stance for the wider well-being of the economy.

Although a surge in repo rates can weigh on purchasing power and personal loan growth, an overall healthy economic outlook will continue to cushion the markets.

India's GDP growth has been forecasted to be 7% in the current fiscal by Fitch, which makes it the fastest-growing emerging economy in the world. In a time when the world economy will register an average growth of 1.7%, India will remain one of its brightest spots.

Manoj Dalmia, founder and director, Proficient equities Private Limited: RBI policy rate is now at its highest level since August 2018. Standing deposit facility rate is adjusted to 6 per cent and the marginal standing facility rate and the Bank Rate to 6.50 per cent.

RBI's GDP growth forecast for the current financial year is seen at 6.8 percent. growth has been reduced from RBI's previous estimate of 7 per cent.'FY23 CPI estimate is at 6.7 per cent and remains unchanged from the previous estimate of the central bank.

Nidhi Aggarwal, Founder, SpaceMantra: The realty sector in India will remain unperturbed by the current surge in repo rates. 'The growth in the realty market won't just be limited to metros but also to tier 2 and 3 cities and smaller townships reflecting a multifaceted nature of expansion, which is a positive sign in the longer run.

Raghvendra Nath, Managing Director, Ladderup Wealth Management: Loan rates will increase even further. 'As the gradual tightening of interest rates ends, it is anticipated that capital inflow would improve even further.

Given the concerns about Chinese demand for oil, the price of petroleum has fallen from its heights and is unlikely to test new highs.

While core inflation is anticipated to stay sticky, crude prices will be kept in check thanks to the strengthening of the rupee and the decline in Chinese demand.

Anindya Banerjee, VP, Currency Derivatives & Interest Rate Derivatives, Kotak Securities: RBI comments on Rupee were also in line with their previous comments. They target volatility and Rupee remains stable on a REER basis. In a way it means, RBI would be watching closely after volatility has increased in USDINR, over the past two trading sessions. 'But without active intervention or announcement of sell-buy swap, we could see USDINR move higher. We expect a range of 82 and 83.

© 2024 Rediff.com -

© 2024 Rediff.com -