India Inc on RBI rate hike

February 08, 2023 15:36

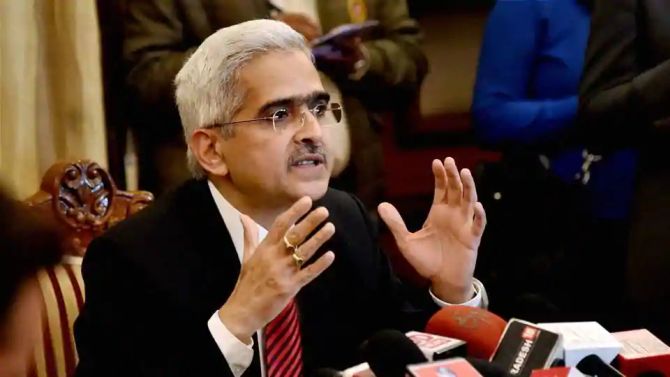

RBI governor Shaktikanta Das

Nilesh Shah, Managing Director, Kotak Mahindra Asset Management Company: "The RBI is playing like Indian cricket team in third one day against New Zealand. Dont take foot of the pedal. After hitting every bowler out of stadium, they dismissed all the batsmen cheaply. The RBI could have said victory over inflation is in sight but instead they are going for absolute containment."

Abheek Barua, Chief Economist and Executive Vice President, HDFC Bank: The policy tone was hawkish as the RBI recognised that they are still away from achieving their objective of durable disinflation. In terms of the inflation risks, the RBI highlighted the elevated nature of core inflation and continuing global risks that could push up domestic inflation going forward.

"Despite the comments on liquidity conditions remaining accommodative compared to pre-pandemic levels signalling a somewhat hawkish tone we expect the RBI to maintain adequate liquidity surplus to remain growth supportive going forward."

The 25 basis points hike in key policy rate by RBI is in line with expectations, and hopefully is the last in the current cycle of rate increase which started in May 2022 in view of rising inflation, opined industry bodies and experts.

It was the sixth hike in a row, though the quantum was low. The central bank has cumulatively hiked repo rate by 250 basis points since May last year in a bid to contain rising inflation in the wake of global geopolitical tensions.

© 2024 Rediff.com -

© 2024 Rediff.com -