Bank recap plan to push GDP growth to 7% in 2019: Report

October 29, 2017 16:35

The government's recapitalisation plan for public sector banks is likely to propel credit growth by up to 700 basis points to 15 per cent and as consequence push up gross domestic product numbers to 7 per cent in the next fiscal, says a report.

The government recently unveiled a Rs 2.1 lakh crore, (representing 1.2 per cent of GDP), recapitalisation package for public sector lenders which will be injected over two years.

The capital infusion will be funded through three sources -- Rs 18,139 crore from budgetary provisions, Rs 58,000 crore from the market as the government dilutes its stake and Rs 1.35 lakh crore through recapitalisation bonds issued by the government.

According to the report by brokerage firm Ambit Capital, lending growth at across banking system was estimated to be at 8 per cent in 2018-19.

However, with recent recapitalisation (recap) plans in play, the credit system is expected to grow to 12-15 per cent during the time period under review.

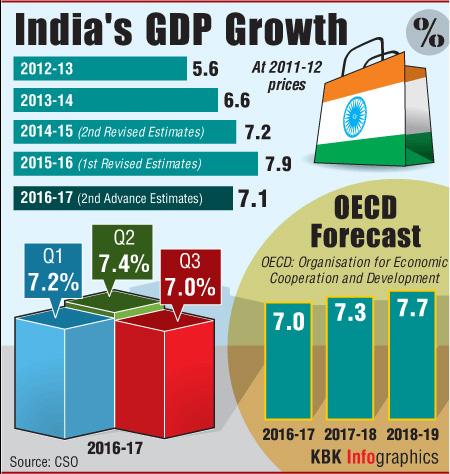

'This in turn is likely to improve prospects of growth for the industrial sector as well as the services sector, thereby propelling headline GDP growth to 7 per cent year-on- year in FY19 from 5.8 per cent in FY18,' the report said.

As per Ambit estimates, industry is likely to see a 7 per cent growth in 2018-19 from 5 per cent in the current fiscal.

Services is projected to grow at 7.3 per cent in the current fiscal and rise to 7.5 per cent in the succeeding year.

Besides, agriculture growth is expected to get a boost from an estimated 1.5 per cent this fiscal to 4.2 per cent in the next financial year.

Meanwhile, Ambit expects government to side-step fiscal prudence as it focuses on winning 14 elections in coming 18 months.

'The government side-stepping fiscal prudence assumes significance particularly because the government has already spent 96 per cent of the full-year fiscal deficit, which has been the highest in the past many years,' it said.

Interestingly, the report noted that contrary to popular belief among other experts, the recap plan can be viewed as being 'fiscally neutral' only if central government's accounts are seen in isolation that is distinct from the PSUs it owns. -- PTI

The government recently unveiled a Rs 2.1 lakh crore, (representing 1.2 per cent of GDP), recapitalisation package for public sector lenders which will be injected over two years.

The capital infusion will be funded through three sources -- Rs 18,139 crore from budgetary provisions, Rs 58,000 crore from the market as the government dilutes its stake and Rs 1.35 lakh crore through recapitalisation bonds issued by the government.

According to the report by brokerage firm Ambit Capital, lending growth at across banking system was estimated to be at 8 per cent in 2018-19.

However, with recent recapitalisation (recap) plans in play, the credit system is expected to grow to 12-15 per cent during the time period under review.

'This in turn is likely to improve prospects of growth for the industrial sector as well as the services sector, thereby propelling headline GDP growth to 7 per cent year-on- year in FY19 from 5.8 per cent in FY18,' the report said.

As per Ambit estimates, industry is likely to see a 7 per cent growth in 2018-19 from 5 per cent in the current fiscal.

Services is projected to grow at 7.3 per cent in the current fiscal and rise to 7.5 per cent in the succeeding year.

Besides, agriculture growth is expected to get a boost from an estimated 1.5 per cent this fiscal to 4.2 per cent in the next financial year.

Meanwhile, Ambit expects government to side-step fiscal prudence as it focuses on winning 14 elections in coming 18 months.

'The government side-stepping fiscal prudence assumes significance particularly because the government has already spent 96 per cent of the full-year fiscal deficit, which has been the highest in the past many years,' it said.

Interestingly, the report noted that contrary to popular belief among other experts, the recap plan can be viewed as being 'fiscally neutral' only if central government's accounts are seen in isolation that is distinct from the PSUs it owns. -- PTI

© 2024 Rediff.com -

© 2024 Rediff.com -